Canada Loan No Credit Check offers individuals the opportunity to obtain a loan without undergoing a credit check process. This type of loan allows borrowers to access funds quickly, regardless of their credit history.

It provides a convenient solution for those who may have a poor credit score or no credit history at all, making it easier to secure financial assistance when needed. With Canada Loan No Credit Check, individuals can overcome the hurdles of traditional loan applications and receive the funds they require in a timely manner.

This type of loan can be particularly beneficial for individuals who have faced financial challenges in the past and are in need of immediate financial support.

The Allure Of No Credit Check Loans In Canada

Explore the allure of no credit check loans in Canada for hassle-free borrowing options. Access quick funds without traditional credit checks for financial flexibility and convenience. Ideal for individuals seeking streamlined loan processes and faster approvals.

Why They’re Popular

No credit check loans are increasingly becoming popular in Canada, especially for people who have poor credit scores or no credit history. The allure of these loans is that they don’t require a credit check, so people who have been denied loans in the past have a chance to get approved. These loans are also convenient since they have a quick application process and funds are usually disbursed within a short period.

Risks And Rewards

While no credit check loans have some benefits, they also come with risks. One of the biggest risks is that they often have high-interest rates and fees. Since these loans are unsecured, lenders may charge higher rates to compensate for the risk they are taking. Additionally, since there is no credit check, the lender doesn’t have a clear picture of the borrower’s ability to repay the loan, which can lead to default and more fees. On the other hand, the rewards of no credit check loans are that they can help people get the funds they need when they are in a financial crisis. These loans can be used to pay off bills or unexpected expenses, which can help the borrower avoid more serious financial problems. Additionally, if the borrower pays the loan on time, they can improve their credit score, which can help them get better loan terms in the future. Overall, while no credit check loans may seem like a good option for people with poor credit, it’s important to consider the risks and rewards before applying. Borrowers should make sure they can afford the loan and understand the terms and conditions before signing any agreement.

Credit: m.facebook.com

Types Of No Credit Check Loans Available

When it comes to obtaining a loan in Canada, having bad credit can be a major obstacle. However, there are options available for individuals who need financial assistance but have a poor credit history. These are known as no credit check loans, which do not require a traditional credit check for approval. Let’s explore the three main types of no credit check loans available in Canada:

Payday Loans

Payday loans are short-term loans designed to provide immediate cash to borrowers until their next paycheck. These loans are usually for small amounts, typically ranging from $100 to $1,500. Payday loans are known for their quick approval process and minimal eligibility requirements, making them a popular choice for individuals with no credit or bad credit.

Installment Loans

Installment loans are another type of no credit check loan that allows borrowers to repay the borrowed amount over a set period of time through scheduled monthly payments. These loans are usually available in larger amounts compared to payday loans, with repayment terms ranging from a few months to several years. Installment loans offer more flexibility in terms of repayment and are suitable for individuals who need a larger sum of money.

Personal Lines Of Credit

Personal lines of credit are revolving credit accounts that provide borrowers with access to a predetermined amount of funds. Once approved, borrowers can withdraw funds as needed and only pay interest on the amount they use. Personal lines of credit are a flexible borrowing option for individuals who require ongoing access to funds and want to build a positive credit history. Overall, these three types of no credit check loans provide options for individuals who may struggle to get approved for traditional loans due to their credit history. Whether you need a small amount of cash until your next paycheck, a larger sum with manageable monthly payments, or ongoing access to funds, there is a no credit check loan available to meet your needs.

Eligibility Criteria For Quick Approval

When applying for a Canada loan with no credit check, meeting the eligibility criteria is crucial for securing quick approval. Understanding the basic requirements and alternative evaluation criteria is essential in order to ensure a smooth and efficient application process.

Basic Requirements

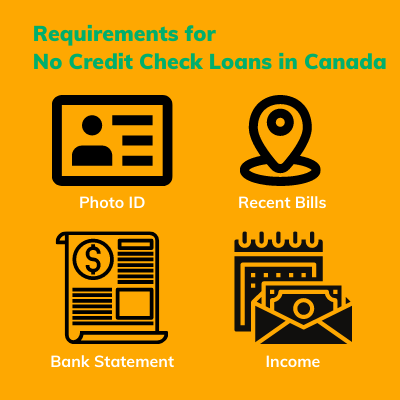

The basic eligibility criteria for a Canada loan with no credit check are straightforward, making it accessible for a wide range of individuals. To qualify, applicants must:

- Be at least 18 years old

- Have a steady source of income

- Provide a valid identification

Alternative Evaluation Criteria

In addition to the basic requirements, alternative evaluation criteria may be considered for quick approval of the loan. Lenders may take into account alternative factors such as:

- Employment history

- Income stability

- Bank statements

Credit: www.fatcatloans.ca

The Application Process Step By Step

Applying for a Canada loan with no credit check is a straightforward process that can be completed in a few simple steps. Here is a breakdown of the application process:

Preparation Phase

- Check eligibility requirements for the loan.

- Gather necessary documents like proof of income and identification.

- Calculate the loan amount needed and repayment terms.

Submission

- Complete the online application form accurately.

- Upload the required documents securely.

- Submit the application for review.

What Happens Next?

After submitting your application, the lender will review your information and make a decision. If approved, you will receive the loan funds in your bank account within a specified timeframe. Ensure to review the terms and conditions of the loan before accepting.

Tips For Fast Loan Approval

If you are in need of a quick loan without a credit check, there are several tips that can help you secure fast loan approval. By following these tips, you can increase your chances of getting the funds you need without the delay of a credit check.

Complete And Accurate Information

Providing complete and accurate information in your loan application is essential for fast approval. Ensure that all your personal and financial details are up to date and accurately entered.

Choosing The Right Lender

When seeking a loan without a credit check, it’s crucial to choose a reputable lender. Look for lenders who specialize in no credit check loans and have a history of providing swift and reliable service to borrowers.

Credit: www.forbes.com

Interest Rates And Fees To Expect

Prepare for your Canada loan with no credit check by understanding the interest rates and fees. Stay informed on the costs involved to manage your finances wisely. Be aware of the terms to make informed decisions when borrowing money.

Interest Rates and Fees to Expect When it comes to obtaining a loan in Canada with no credit check, it’s crucial to be aware of the interest rates and fees you may encounter. Understanding the associated costs can help you make informed decisions and avoid any financial surprises down the road. How Rates Compare Comparing interest rates from different lenders is vital when seeking a no credit check loan in Canada. Interest rates can vary significantly between providers. It’s essential to shop around and compare offers to ensure you secure the most competitive rate available. Avoiding Hidden Fees In addition to interest rates, borrowers should be mindful of potential hidden fees that may accompany no credit check loans in Canada. These fees can include origination fees, prepayment penalties, and late payment charges. Before committing to a loan, carefully review the terms and conditions to avoid any unexpected costs. Moreover, understanding the repayment structure of the loan can help borrowers anticipate and plan for any additional fees that may arise. By being aware of these potential costs, borrowers can effectively manage their finances and avoid any unnecessary financial strain. In conclusion, being well-informed about interest rates and fees associated with no credit check loans in Canada is essential for making sound financial decisions. By comparing rates and understanding potential hidden fees, borrowers can secure a loan that aligns with their financial goals while avoiding any unexpected costs.

Pros And Cons Of No Credit Check Loans

No credit check loans in Canada offer quick access to funds without impacting your credit score. However, the high interest rates and potential for predatory lending practices are major drawbacks. These loans can be a helpful solution for individuals with poor credit, but careful consideration is necessary due to the associated risks.

Immediate Benefits

No credit check loans offer quick access to funds without impacting credit score. They are ideal for emergencies and have easy approval processes.

Potential Long-term Implications

However, higher interest rates are common with no credit check loans. Repayment terms may be shorter, leading to financial strain in the long run.

Alternatives To Consider

Consider exploring alternative options for obtaining a loan in Canada without a credit check. Explore credit unions, online lenders, and peer-to-peer lending platforms as potential alternatives to traditional banks. These options may offer more flexible requirements and faster approval processes.

Canada Loan No Credit Check offers a quick solution, but there are other options to explore.

Secured Credit Options

Secured credit cards require a cash deposit to establish credit.

Credit Building Tools

Use credit builder loans to improve credit score gradually. Consider secured credit cards and credit builder loans.

Frequently Asked Questions

Can You Get A No Score Loan In Canada?

No, it’s not possible to get a no-score loan in Canada. Lenders require credit history for approval.

Is It Possible To Borrow Money Without A Credit Check?

Yes, it is possible to borrow money without a credit check from certain lenders.

How Can I Borrow $200 Dollars Instantly In Canada?

To borrow $200 instantly in Canada, you can explore online lending platforms or consider payday loan options. These platforms provide quick and convenient access to small loans, usually with a simple application process. Remember to compare interest rates and terms before making a decision.

Which Type Of Loan Does Not Require A Credit Check?

A payday loan or cash advance loan typically does not require a credit check. These types of loans usually have short repayment terms and high interest rates. However, it’s important to carefully consider the terms and fees before taking out a loan.

Conclusion

Canada loans with no credit check offer a convenient and accessible solution for individuals in need of financial assistance. These loans eliminate the hassle of credit checks and provide a quick and straightforward application process. Whether you have a poor credit history or no credit at all, this option can help you secure the funds you require.

With their easy accessibility and fast approval, these loans are a viable choice for many Canadians facing financial challenges.